Carbon Offsetting, Carbon Neutral, Net Zero. What are they and why should small-cap boards care?

Over the past 18 months, we’ve seen a noticeable shift in the Environmental, Social and Governance (ESG) landscape. Investors like BlackRock have scaled back involvement in collective initiatives such as the now under-review Net Zero Asset Managers Initiative (NZAMI).

But this shift is an evolution, not a retreat. It reflects a maturing of how firms should approach their ESG strategy, moving from broad idealism to focused pragmatism. Companies are now increasingly expected to identify and manage a more limited set of ESG issues that are most material to their business, rather than pursue ESG for its own sake.

So, what ESG issues matter to AIM-listed companies in 2025?

Despite geopolitical uncertainty, climate and net zero remains a top priority. On top of existing obligations, such as Task-Force on Climate Related Financial Disclosures (TCFD) aligned reporting, incoming UK Sustainability Reporting Standards (SRS) are expected to require UK companies to report on their approach to becoming net zero by 2050. This is just one of several steps reinforcing the UK government’s long-term climate strategy. The direction of travel is clear: net zero remains firmly on the boardroom agenda.

But what net zero actually means, and what “counts” towards it, isn’t always clear. Can carbon offsets be used? What if they’re low quality? Is “carbon neutral” the same thing? Directors need to understand the differences, the potential pitfalls, and how these terms translate into credible business action. Misunderstanding or misapplying them can expose a company to reputational, regulatory, and financial risk.

In this article, we’ll explain three common climate terms - carbon offsetting, carbon neutral, and net zero. We’ll break down what they mean, how they’re different, and why AIM company boards need to understand them.

What does Carbon Neutral mean and how does it differ from Net Zero?

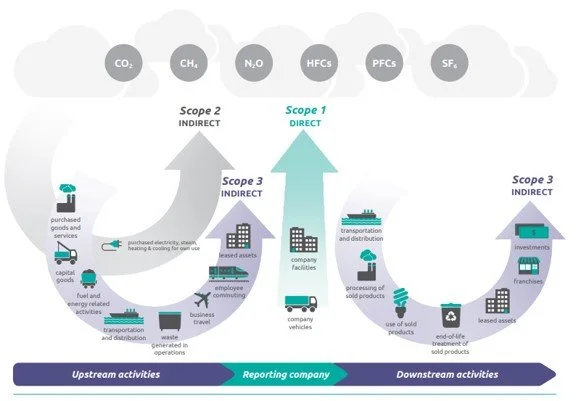

Once firms have calculated their emissions across the three scopes defined by the Greenhouse Gas Protocol, Scope 1 (direct emissions), Scope 2 (indirect emissions from purchased energy), and Scope 3 (all other indirect emissions across the value chain), they have a foundation for public commitments to either become Carbon Neutral or reach Net Zero. These terms are often used interchangeably, but they have important differences.

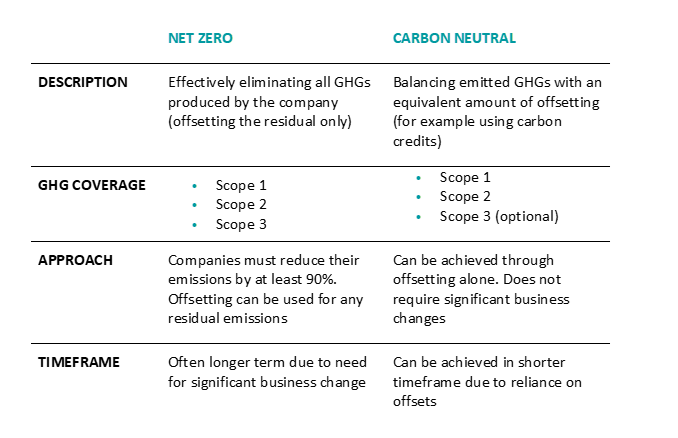

Carbon Neutrality means balancing the amount of carbon dioxide (CO₂) a company emits by removing an equivalent amount from the atmosphere. It can often be achieved through offsetting, such as paying for tree planting or renewable energy projects that remove or avoid emissions outside of the company’s operations. While this may involve some emission reductions, the core idea is to cancel out the emissions being produced.

Net Zero, on the other hand, goes further. It requires a company to reduce its emissions as much as possible across all greenhouse gases. Only the small amount of emissions that cannot be eliminated should be “neutralised” by using high-quality offsets - offsetting is still used, but only as a last resort after reductions have been maximised. This is the key difference between the two terms. This is further summarised in the table below.

Essentially, Net Zero is focused on not creating the emissions in the first place whereas Carbon Neutral is focused on balancing out the emissions being produced through offsetting.

Carbon Offsetting refers to the act of compensating for emissions by funding the reduction or removal of greenhouse gases elsewhere, often by purchasing carbon credits created by another company based on their reduction activities. Offsets can play a role in both Carbon Neutral and Net Zero strategies, but their use and quality matters. Different offsets can have different levels of credibility - for example some offsets are based on carbon credits that do not reliably reduce emissions vs the status quo or that do not lock in emissions reductions permanently (planting trees might pull CO2 out of the atmosphere initially but if you cut the trees down and burn them then that CO2 is released again). A company that is overly reliant on offsets without reducing its own emissions can be exposed to accusations of greenwashing if those offsets are shown to be low quality.

Is there a regulatory requirement for AIM firms to offset or reduce emissions?

Although there is no specific regulation requiring firms to offset or reduce their greenhouse gas (GHG) emissions, as part of the duties under S172 of the Companies Act, Directors have an evolving responsibility for the company's impact on the environment and the long term financial sustainability of the company.

Depending on whether you're AIM or FTSE listed, there are rules for firms over certain thresholds to report on their emissions and reduction efforts including Streamlined Energy and Carbon Reporting (SECR), and management of Climate related risks and opportunities via TCFD framework The Companies (Strategic Report) (Climate-related Financial Disclosure) Regulations 2022.

What common issues do AIM companies run into?

Issue 1: Inconsistent terminology

AIM companies often use terms like Carbon Neutral, Net Zero, Climate Neutral, Carbon Positive, and Net Positive inconsistently. With no universal definitions and the ability to self-certify, it becomes difficult for stakeholders to assess what a company is actually committing to or achieving. This lack of standardisation undermines companies taking credible action, as it erodes trust and invites increased scrutiny. Investors, clients, and regulators are becoming more aware of these inconsistencies and are now asking tougher questions about the substance behind such claims.

Issue 2: Reliability of Offsetting

Carbon offsetting involves investing in projects that reduce or remove greenhouse gas emissions, often with additional benefits for local communities and ecosystems. This can be done in two main ways:

Insetting – financing projects within a company’s own value chain

Offsetting – purchasing carbon credits from external schemes

Among AIM companies, offsetting through the purchase of carbon credits is far more common. However, this approach has well-documented challenges. Forest-based offsets, for example, only store carbon temporarily - trees can be lost to wildfires, logging, or disease. Worse still, some offset schemes have been criticised for double-counting or offering credits for protecting areas that were never at risk. If an offset is unreliable, any claim to Carbon Neutrality based on it is also unreliable.

Issue 3: Limitations of Offsetting

Offsetting is not equivalent to reducing emissions. As a result, achieving Carbon Neutral status through offsets is increasingly viewed as a temporary step, not the end goal. With growing pressure to reach Net Zero by 2050, stakeholders now expect AIM companies to prioritise emissions reduction and only use offsets for a small portion of residual emissions.

What does this all mean for company boards?

Take board level accountability for climate performance. Monitor progress and robustly challenge plans and approaches. Third party accreditations for Carbon Neutral and Net Zero will help build confidence internally and externally.

Understand key client and investor expectations for the firm with regards to carbon reporting and Net Zero commitments against current positioning - what are the risks and opportunities. Benchmark ESG positioning and strategies against peers to identify current and potential future competitive advantages.

Carbon Neutral or Net Zero - choosing the right path. AIM firms are under increasing financial pressure as well as a lack of bandwidth. A firm needs to balance the effort in achieving Carbon Neutral, an interim step, over focusing on Net Zero commitments which may take longer to achieve, but will likely deliver a greater return on investment both reputationally and financially.

Keep the language simple - terminology is confusing and confused. We live in a world where Carbon Negative means the same as Carbon Positive. Communicate plans to stakeholders simply and clearly, diagrams are worth 1000 words. If terminology like Carbon Neutral is being used, make sure there is an explanation of what is meant by this - what is included, is the company reducing and/or offsetting, how is this being achieved, how is it being monitored, who is accountable, what are the constraints or assumptions, track and share progress.

If using offsets, be right rather than fast - undertake thorough due diligence before committing. Investigate insetting options via the supply chain. Prioritise permanent carbon removal and projects which reduce carbon emissions. Try to achieve a balance of initiatives. Make sure carbon credits are tracked, to avoid double counting, and additive, i.e., the carbon offset would not happen without the credit investment.

About Addidat

At Addidat we strive to remove the ESG burden in the small-cap market, and to help companies thrive and build long-term resilient businesses.

With our AI-driven platform that ingests and analyses disclosures, combined with a team of ESG experts experienced in investment management and running AIM-listed businesses, we are uniquely positioned to help UK small-cap companies enhance their annual reporting in a proportionate way.

The Addidat Platform provides companies and investors with market leading small cap data, as well as strategic and regulatory insights. This allows AIM-listed businesses to understand, which regulations may apply to them, what ESG topics are material to their company, and understand what peers are doing to spot opportunities to differentiate.