Not All Is Equal in the Carbon Offset Market - How to Mitigate Greenwashing Concerns

With an increasing number of UK small-cap and AIM firms investing in their Net Zero strategies, and the threat of greenwashing increasingly front of mind, establishing environmental strategies and communicating them confidently is a challenge for many company executives and Boards.

One of the biggest areas of greenwashing relates to offsetting and the perceived false claims of carbon neutrality. Yet nearly all companies will likely need to offset some emissions eventually to reach their environmental commitments.

So, how do companies continue to invest and communicate progress on their Net Zero strategies with confidence? Firstly, understand the key terminology and ensure commitments are being communicated accurately. Our data shows that key concepts are not always understood, and terms are misused.

Building on our short article last year, where we explain the greenwashing challenge and that Net Zero is not the same as Carbon Neutral, here we expand on carbon offsetting, and explain that carbon credits are not the same as carbon offsets, and not all carbon offsetting approaches are equal.

Carbon offsetting, carbon credits, and carbon removal

We hear these terms in relation to climate change mitigation regularly, but what do they mean?

A carbon credit, in its truest form, is a reduction in greenhouse gas (GHG) emissions released into the atmosphere, and transacted on mandatory markets. For example the EU’s Emissions Trading Scheme (ETS), which allows regulated companies whose energy usage is capped, to trade under, and over-utilised emissions to effectively balance out their carbon emissions. These are called cap-and trade programmes, which alongside carbon taxes, an upfront fee applied to GHG emissions, are the two tools that governments use to mandate carbon pricing today. However, only a small number of companies, typically those generating power or in energy-intensity industries, fall under mandatory cap-and-trade or taxation schemes today.

For the vast majority of AIM and UK small cap companies, the concept of carbon credits relates to their participation in voluntary credit schemes to offset their emissions, where companies buy carbon offsets via Verified Carbon Standard (VCS) programmes, for example. Where carbon credits reduce overall emissions produced in regulated markets, carbon offsets relate to the removal, or sequestration, of carbon dioxide (the most abundant GHG) from the atmosphere.

However, there are many different approaches to carbon removal and not all methodologies, and therefore offsets, are equal.

The different approaches to carbon removal

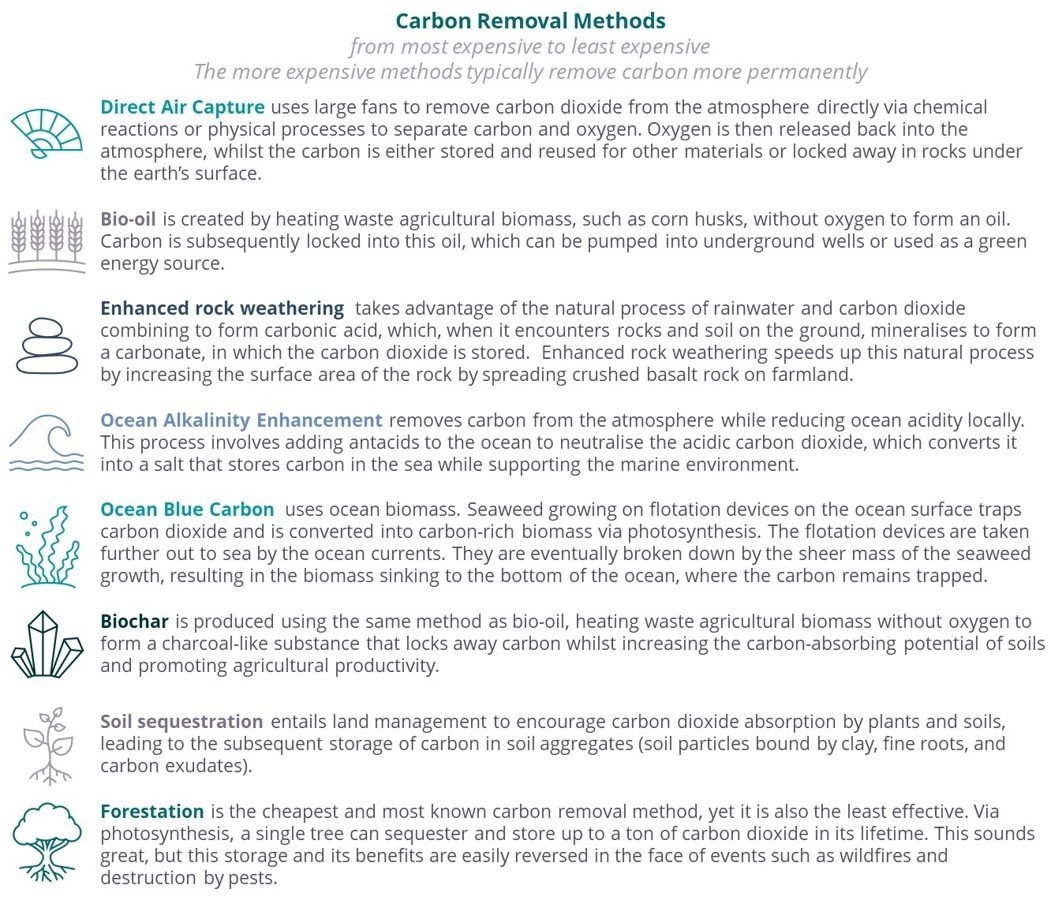

Various carbon removal methods exist, ranging from nature-based to man-made methods. Nature-based methods include processes such as forestation and soil carbon sequestration – these methods appear more attractive, as they generally cost around only £20 per tonne of carbon; however, they are less permanent and simply buy us more time, rather than solving the issue.

On the other hand, technological methods are more permanent solutions that will lock carbon away for thousands of years. However, they come at a greater cost, ranging from £150-200 per tonne of carbon, but with more significant long-term benefits.

Example carbon removal methods

There are also other GHG offsetting projects, for example capturing methane leakage from fossil fuel production and livestock.

Looking ahead

The Intergovernmental Panel on Climate Change (IPCC), the United Nations body created to provide policymakers with regular scientific assessment on climate change, has developed more than five different pathways for keeping global warming under 2°C, and they all involve carbon removal playing a part in some way, alongside continued efforts to reduce emissions. The IPCC found that we must remove ten gigatons (that’s ten billion tonnes) of carbon dioxide annually by 2050. Currently, only two billion tonnes a year are being removed, mostly accounted for by land-based, short-term, non-durable carbon removal.

Concerns have been raised that demand for offsets will outstrip supply and there is encouragement to secure carbon offsets sooner rather than later, however others are more confident in the outlook, and estimate that by 2030, up to $400 billion dollars will be invested into carbon technology.

What does this mean for companies?

In addition to ensuring terminology is being used accurately internally and to external stakeholders our advice is for companies to focus their investment on emission reduction over offsetting to support the overall fight against the climate-crisis. Meanwhile, as technology is still in its relative infancy, and the quality of carbon removal options should increase in permanence whilst hopefully reducing in cost. Reducing emissions will help deliver Net Zero targets, where 90% of baseline emissions need to be avoided in future state and only 10% offset, and this will also help mitigate future carbon pricing and taxation risks, one of the most widely reporting risks in AIM company TCFD reports.

However, there are obvious planetary and potential reputational benefits to offset emissions ahead of the eventual need to achieve Net Zero targets. To mitigate any greenwashing concerns, companies who chose to invest in voluntary offsetting schemes must conduct due diligence on offsetting partners, be prepared to invest in more permanent removal options, diversify the offsetting projects invested in, and review the offsetting approach periodically as technology evolves.

To discuss further, please get in touch with the team.

Never miss an update from Addidat. Subscribe to our monthly Newsletter by following this link.